Crude Inventory Draw Unable to Boost Oil Prices

The

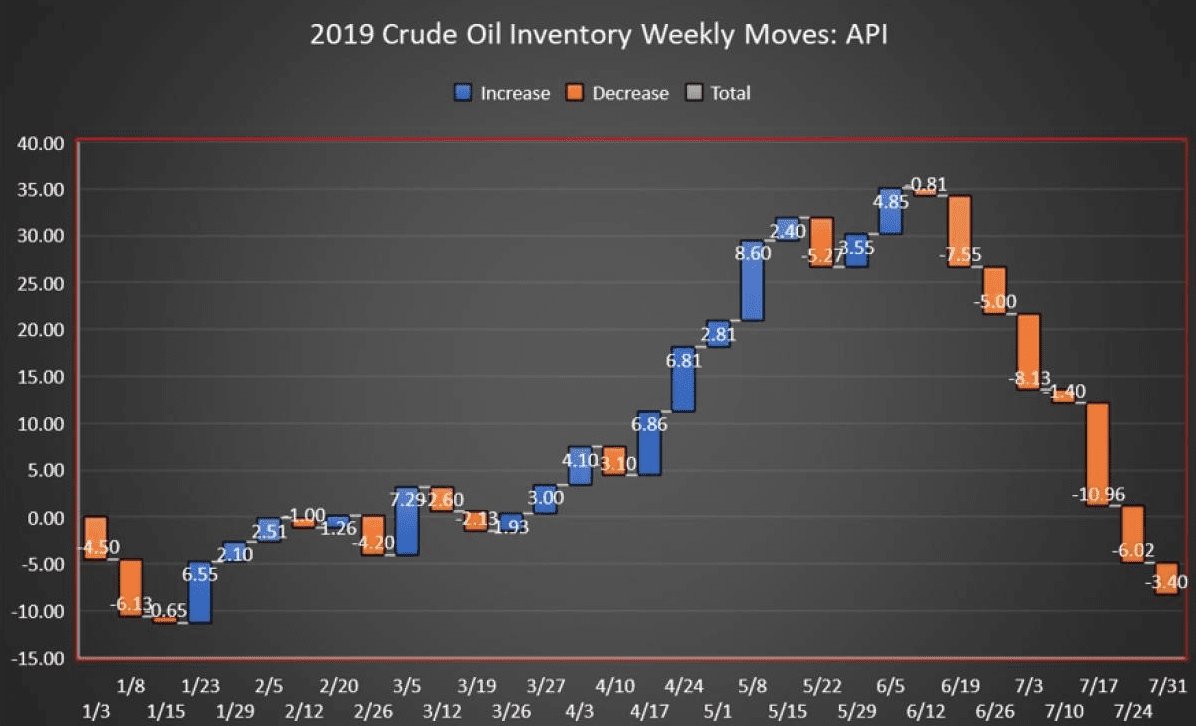

inventory draw this week compares to last week’s large draw of 6.024 million

barrels, bringing the net inventory moves for the year into net draw territory,

according to API data. A day later, the EIA confirmed an inventory drawdown of

8.5 million barrels.

After

today’s inventory move, the net draw for the year is 8.23 million barrels for

the 32-week reporting period so far, using API data.

Oil

prices were trading down on Tuesday on the China/US trade escalations and signs

of the resulting weakening demand growth. The EIA reported on Tuesday that it

was revising downward its global oil demand growth for 2019 to 1 million

barrels per day.

At

2:40pm EST, WTI was trading down $0.77 (-1.41%) at $53.92—more than $3 off from

last week’s price. Brent was trading down $0.59 (-0.99%) at $59.22—almost $5

down on the week.

The

API this week reported a 1.1-barrel draw in gasoline inventories for week

ending Aug 1. Analysts predicted a draw in gasoline inventories of 722,000

barrels for the week.

Distillate

inventories rose by 1.2 million barrels for the week, while inventories at

Cushing fell by 1.6-million barrels.

US

crude oil production as estimated by the Energy Information Administration

showed that production for the week ending July 25 rebounded to 12.2 million

bpd, just 200,000 bpd off the all-time high of 2.4 million bpd.

The

U.S. Energy Information Administration report on crude oil inventories is due

to be released at its regularly scheduled time on Wednesday at 10:30a.m. EST.

By 4:41pm EST, WTI was trading down at $53.75 while Brent traded at $59.04.