The Great American Oil and Natural Gas Pipeline Boom

This makes sense:

since 2008, U.S. crude oil and gas production have respectively boomed 150% to

12.3 million b/d and 60% to 90 Bcf/d.

Pipelines get

approved in the first place because rising usage demands it.

Originating in

Texas, we track nearly 40 pipelines covering 11,000 miles either being built or

in pre-construction development.

Just a few days

ago the DC Circuit Court of Appeals upheld FERC orders approving the 197-mile,

1.7 Bcf/d Atlantic Sunrise Project (connecting PA gas to mid-Atlantic markets),

denying numerous objections from anti-gas environmental groups.

The court backed

FERC's position of market need for the pipeline, specifically citing evidence

that there were contracts for 100% of the capacity.

Indeed, very

quietly, the International Energy Agency reports that the U.S. led the world in

2018 for new oil demand (+540,000 b/d) and new gas demand (+7.8 Bcf/d). (read

that again).

For comparison,

the annual increase in U.S. gas demand in 2018 was equivalent to the UK's

current consumption.

As the main sector

of use, U.S. gas demand for electricity has soared 60% since 2008 to 30 Bcf/d.

Just as

importantly, we are building an immense oil and gas export complex to bring

reliable and affordable fuels to an energy-deprived world.

Now the largest

oil and gas producer, we will probably become the largest exporter of both

within five years.

In the rich

Western economies, for instance, oil and gas supply over 60% of all energy.

Gas is especially

the go-to fuel to lower emissions while backing up wind and solar power.

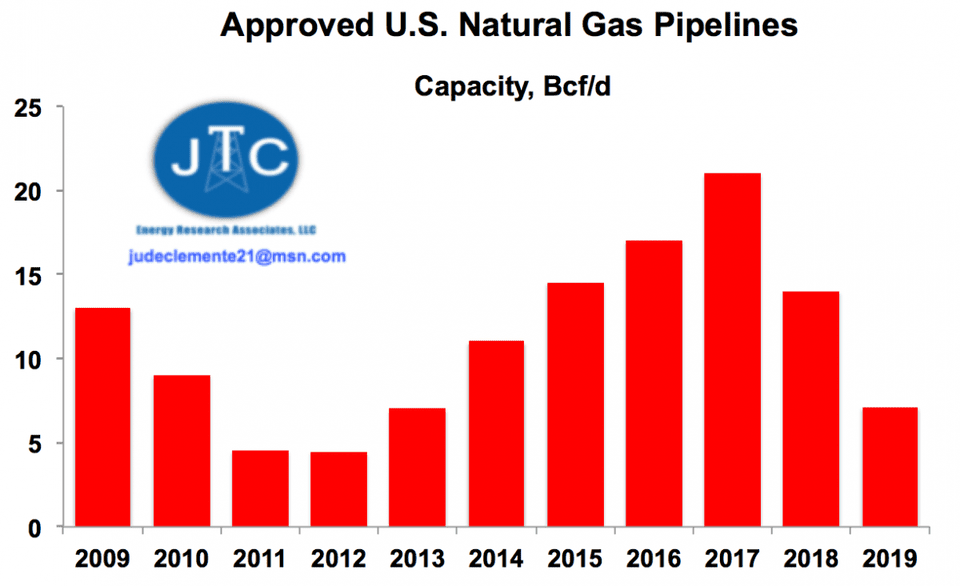

The EIA is

currently tracking over 160 new U.S. gas pipeline projects, with a staggering

113 Bcf/d of capacity.

In Appalachia (OH,

WV, PA), for instance, where nearly 40% of U.S. natural gas is produced, there

is a whopping $32 billion in new pipelines in the works.

This will add 23

Bcf/d of new takeaway capacity to a region that already produces 33 Bcf/d.

"Northeast

region slated for record natural gas pipeline capacity buildout in 2018;"

"Another New Gas Pipeline Is Coming to the Permian Basin."

These build-outs

are essential.

The U.S.

Department of Energy reports that the majority of new power plants in this

country will be natural gas, a hefty 235,000 MW of additional gas capacity in

the coming decades.

It could actually

be even higher given how low gas prices are.

Lowering the

ability of other power sources to compete, some expect U.S. gas prices to not

clear the $3 range until 2026 at the earliest

Gas pipelines are

good for the environment too: BNEF reports that more natural gas "has done

more to curb U.S. carbon emissions in the past decade than any other single

factor, including new renewable build."

Down in Texas, the

Permian pipeline boom continues apace.

And for good

reason: the Permian basin now produces 33% of U.S. crude oil and 16% of natural

gas.

With the largest

U.S. oil and gas discovery ever in December, doubling our reserves, the

Permian's future remains very bright.

In particular,

crude pipelines have low barriers to entry.

The Permian is

expected to quickly go from a bottleneck region to potentially having more pipe

than crude production can fill.

One key goal for

Permian producers is to soar the play's 400,000 b/d capacity to Corpus Christi,

Texas for export.

By the end of the

year, there should be some 1.7 million b/d of capacity to Corpus Christi.

Surpassing the

Port of Houston, the Port of Corpus Christi will likely become the largest

crude export terminal in the U.S. over the next seven to 10 years.

Midstream

companies are now building 4.6 million b/d of crude capacity out of the Permian

to the Gulf Coast, set to enter service from end-2019 to the first-half 2021.

Places like New

York and New England have shown that pipeline blocking means energy prices that

are 50% or higher above the national average, hurting American families and

businesses.

Other key issues

supporting pipelines include President Trump's Executive Order to stop

individual states and governors from blocking projects that could greatly

benefit other states.

And the hot topic

of enhanced cybersecurity is critical for the oil and gas industry.

Reducing leaks and

accidents is a top priority because it stops lost product and maintains a

corporation's invaluable reputation.

In fact, the oil

and gas industry has been pushing for more communication with federal

regulators.

For example, the

Interstate Natural Gas Association of America just appointed ex-TSA offifical

Michael Isper to the newly created role of director of security, reliability

and resilience.

The key takeaway

of the ongoing U.S. pipeline success story is simple: bet on oil and natural

gas.

The U.S. Department of Energy projects that oil and natural gas will still supply over 65% of our energy in 2050.